As anyone involved with ESG will attest, the current level of demand for ESG leadership talent is unsurpassed and unrelenting.

Even firms with long-standing track records of successfully integrating ESG principles into their organizations are finding it more difficult than ever to stay ahead of dynamic and constantly evolving ESG expectations. Companies that have previously resisted establishing a formalized ESG policy and framework are finally bowing to pressure from their investors, consumers, employees, boards and regulators, and now find themselves scrambling to catch up. As ESG has gone from being a functional requirement to a commercial imperative, best-in-class organizations are embracing ESG in part because they firmly believe in the financial benefits of incorporating sustainability into their corporate and investment strategies.

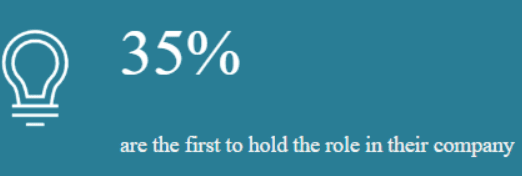

All of these factors have led to an avalanche of demand for ESG leadership talent, straining what was already a very thin talent pool. It is clear that next-generation ESG leaders will look quite different from earlier archetypes, as the scope of the role grows and requires a far more senior and agile executive to be considered as a credible “ESG 2.0” leader.

To better understand this shift and the specific competencies and experience that firms are seeking, Russell Reynolds Associates analyzed the backgrounds of 46 senior ESG leaders from large, global organizations appointed over the past 18 months. Our data reveal that these leaders are predominantly female, overwhelmingly hired from outside of the company versus being promoted into the role, and bring cross-functional business expertise to the position.